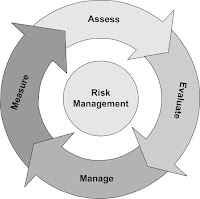

Overview of Risk Management

As a risk

manager, what is the most concerned? First of all, risks and the

threat of risks must have little impact on the business processes as

possible. This is really our underlying mission.

We want to

achieve for officer of our organization, for executive management,

for stakeholders and shareholders, what we want is to give back to

them, as a risk manager, is an acceptable level of predictability on

the day to day basis. An a level of assurance or reliability, the

threat and attack of our organization and other vulnerabilities are

going to bring it down to our needs or impede the operations of our

business or organization to a point what substantial of loss as seen.

The

process of risk management is often going to be combined with the

Business Impact Analysis (BIA). In other words, how can we do a

relevant risk management program if we don't really understand the

nature and the extent of risks to our information resources, to our

data resources, to our physical and logical resources and the

individual potential impacts on our activities? Without this impact

analysis, we are not going to be able truly manage risks in an

effective way.

The

Business Impact Analysis (BIA) isn't going to be possible without

information asset classification or identify our assets, classify our

assets and setting the value of our assets, and that's really the

main aspects of risk management and risk

assessment. If our company can't do a full BIA, we can do

another kind of less desirable option that it's called Business

Dependency Evaluation (BDE) which basically determines overall macro

criticality and sensitivity of our organization information

resources.

The result

of this would drive management to weigh the risk exposure with the

costs to mitigate those risks as well as all of the financial,

personal and time overhead it takes to implement countermeasures and

controls in the organization.

Now just

other disciplines that relate to information security. They are that

risk assessment can be quantitative or qualitative. If it's

quantitative basically means we got a mathematical formula involved,

for example ALE, which is the Annual Loss Expectancy, that would be

the value of an asset multiply by exposure factor multiply by the

annualized rate of occurrence. On the other hand, a qualitative risk

assessment is going to be a little more hypothetical. This is based

on human judgement, intuitions and the experience of the people who

assess the risk.

Of course,

from all of this, several positive outcomes should result that we'll

see in next posts.

Best regards my friend

and remember, if you have any question, go

ahead!!

Commentaires

Enregistrer un commentaire